Prioritizing FAIR DATA for Strengthening Mergers and Acquisitions

Biotech Mergers and Acquisitions are on the Rebound

In the current business environment of drug development, understanding the market can be mission-critical to success. There are notable standouts of drugs that reached the market fueled by a recent acquisition, like Zolgensma. “The FDA granted the approval of Zolgensma to AveXis Inc.” in 2019, with many special designations: fast track, breakthrough therapy, priority review, and orphan drug.¹ The timeline of this acquisition included the critical date of Novartis announcing the deal in April 2018.² AveXis was founded in 2012 and, in only six years, was acquired for $8.7 billion. Examples in which legacy pharmaceutical giants are leaning into acquiring young biotech ventures are not uncommon. In 2021 and 2022, it was quieter on the merger and acquisition front for biotech, perhaps impacted by shifts in priorities due to COVID-19. Then in 2023, “the value of the top 10 M&A deals in the biopharma industry came to $115.8 billion, outranking prior sums from 2022, 2021, and 2020, which came to $65 billion, $53 billion, and $97 billion, respectively.”³ The demand for innovative, novel therapeutics appeared renewed. This symbiosis between young biotech innovators and legacy powerhouses was impacting global health by bringing life-changing solutions to market.

On July 8th, “MedPharm, Ltd., an Ampersand Capital Partners portfolio company, and Tergus Pharma, a Great Point Partners portfolio company, jointly announced a merger. The combined topical and transepithelial Contract Development and Manufacturing Organization (CDMO) will operate under the MedPharm name, establishing a leading, end-to-end CDMO with robust scientific, clinical trial manufacturing, and commercial production capabilities.”⁴ This example of a recent merger again highlights the reinvigorated potential of the biotech market trending forward. “The global biotechnology market size was estimated at USD 1.38 trillion in 2023 and is expected to be worth around USD 4.25 trillion by 2033, poised to grow at a noteworthy CAGR of 11.8% from 2024 to 2033.”⁵ This growth may be fueled by the continued positioning of mergers and acquisitions.

“Tokyo-headquartered Otsuka Pharmaceutical Co. Ltd. said Aug. 1 that it will acquire Boston-based Jnana Therapeutics Inc. through a potential $1.125 billion M&A deal. Under the terms, Otsuka will work to close the transaction by the third quarter of 2024, with $800 million paid out to Jnana shareholders, along with up to $325 million in additional development and regulatory milestone payments.”⁶ With this example of Otsuka jumping into the arena, there is a breadth of markets showcasing strategies of mergers and acquisitions, from North America to Europe and Asia Pacific.

2024 is shaping up to be a pivot year of mergers and acquisitions for life sciences. Let’s chat about implementing strategies that unlock the core value of a new acquisition: the data.

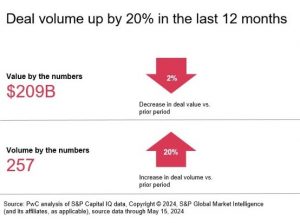

2024 is shaping up to be a pivotal year in terms of mergers and acquisitions in the pharmaceutical and life sciences industries, continuing the trend of renewed investment in mergers and acquisitions with players from a global market. PwC’s analysis of S&P Capital IQ data shows a 20% increase in deal volume vs. the prior year period, with a valuation of $209B.⁷ This, combined with the knowledge that over 60 different countries are holding elections this year, points to a core need to create robust strategies in positioning for or navigating a merger or acquisition.⁸

FAIR Data for Unlocking the Value of a New Asset

One of the most difficult challenges faced in an acquisition or merger is how to unlock the value of the new asset. There are a myriad of personnel, operational, and technological challenges to maneuver. The more efficiently and tactically this can be accomplished, the sooner the rewards of the investment are realized. In the race against the clock of a patent, every day on the market without a biosimilar or generic competitor is a maximum value to shareholders.

As technology advances, how can a company implement strategies that empower efficiency in getting to the core value of a new acquisition: the data?

“In 2016, the ‘FAIR Guiding Principles for scientific data management and stewardship’ were published in Scientific Data. The authors intended to provide guidelines to improve the Findability, Accessibility, Interoperability, and Reuse of digital assets. The principles emphasize machine-actionability (i.e., the capacity of computational systems to find, access, interoperate, and reuse data with none or minimal human intervention) because humans increasingly rely on computational support to deal with data as a result of the increase in volume, complexity, and creation speed of data.”⁹

The relationship between these two concepts is evident. FAIR Data is the clear way forward to demystify the data locked within any company. With agnostic data, companies can expedite the timeline to fuse together two separate, siloed, and unique sets of processes and data. ZONTAL’s approach revolutionizes data usability. By storing data in a semantic database, ZONTAL eliminates the arduous task of Extract, Transform, Load. This innovation propels efficiency and empowers users to concentrate on valuable analysis and visualization endeavors, thus unlocking the value of the merger or acquisition at a more rapid pace.

“Major (bio)pharmaceutical companies value their data as an essential corporate asset and consider FAIR a key driver of their digital transformation; companies providing services and solutions for research also display FAIR in their portfolios.”¹⁰,¹¹,¹²

ZONTAL is a leading partner for companies looking to discover the value of FAIR data. Let’s start a conversation today on how we can be your trusted partner in discovering the true value of data.

Contact ZONTAL to accelerate your next merger and acquisition.

Sources:

- FDA approves innovative gene therapy to treat pediatric patients with spinal muscular atrophy, a rare disease and leading genetic cause of infant mortality | FDA

- Novartis enters agreement to acquire AveXis Inc. for USD 8.7 bn to transform care in SMA and expand position as a gene therapy and Neuroscience leader | Novartis

- The top 10 biopharma M&A deals of 2023 | Fierce Pharma

- MedPharm, Ltd. and Tergus Pharma Merger Forms Topical and Transepithelial CDMO Leader – MedPharm

- Biotechnology Market Size to Worth Around USD 4.25 Trillion by 2033 (precedenceresearch.com)

- Otsuka to buy Boston chemoproteomics biotech for up to $1.1B | BioWorld

- Pharmaceutical and life sciences: US Deals 2024 midyear outlook: PwC

- US Deals 2024 midyear outlook: PwC

- FAIR Principles – GO FAIR (go-fair.org)

- Wise, J. et al. Implementation and relevance of FAIR data principles in biopharmaceutical R&D. Drug Discov. Today 24, 933–938 (2019).

- Gu, W., Hasan, S., Rocca-Serra, P. & Satagopam, V. P. Road to effective data curation for translational research. Drug Discov. Today 26, 626–630 (2021).

- Rocca-Serra, P., Gu, W., Ioannidis, V. et al.The FAIR Cookbook – the essential resource for and by FAIR doers. Sci Data 10, 292 (2023). https://doi.org/10.1038/s41597-023-02166-3

>

>